The Importance of Financial Planning

Financial planning is the foundation of a secure and successful financial future. It creates a personalized roadmap for effectively managing your income, expenses, savings, and investments. By having a solid financial plan, you can confidently navigate life’s milestones—like buying a business, saving for college, or planning for retirement—while staying prepared for unexpected challenges.

A well-structured financial plan empowers you to make informed decisions, set measurable goals, and build lasting confidence in your financial health. Whether your objective is growing your wealth, reducing debt, or achieving retirement security, financial planning aligns your resources with your long-term aspirations for stability and success.

Why Choose Appleseed Wealth Management for Investment Planning

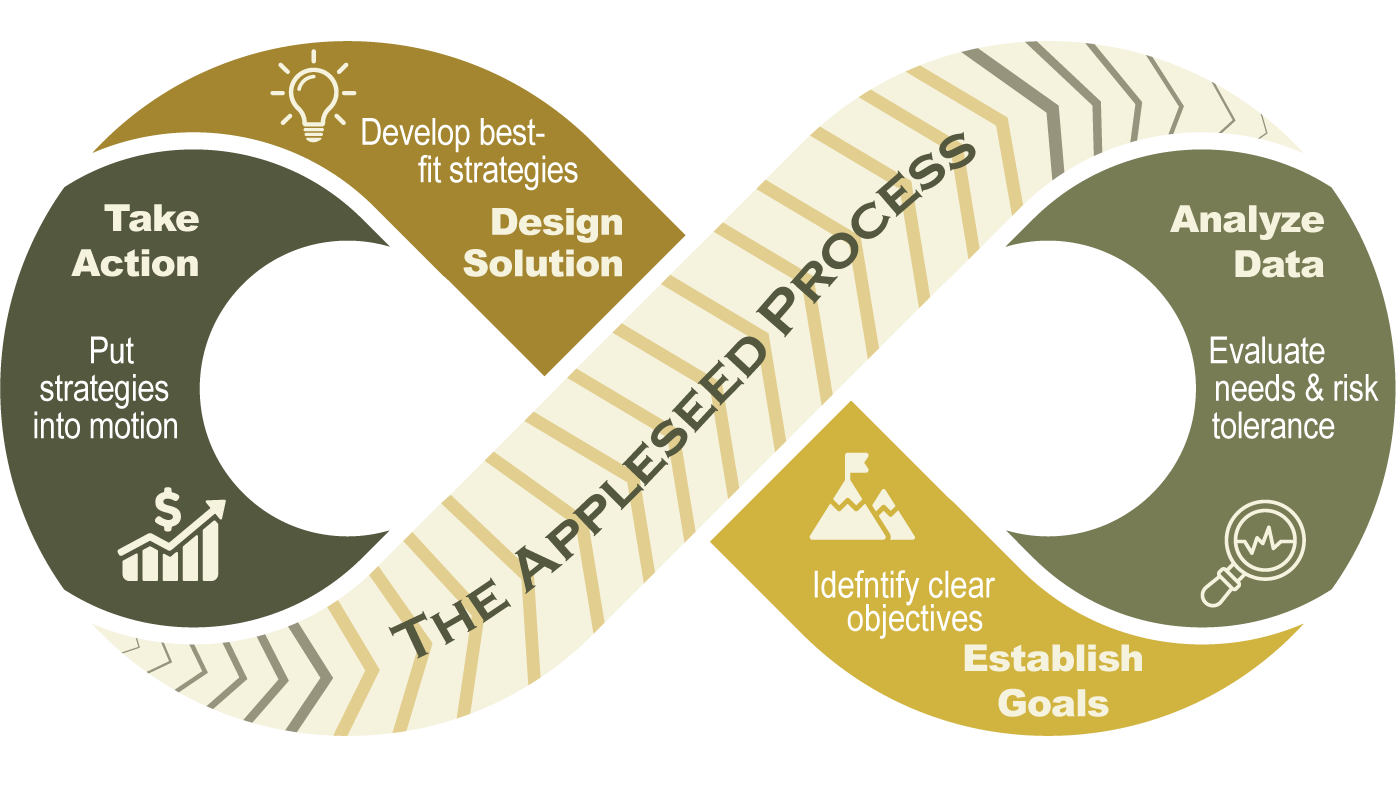

At Appleseed Wealth Management, we understand that investment planning is not one-size-fits-all—it’s personal. Our experienced team specializes in creating customized investment strategies tailored to your unique goals, risk tolerance, and financial priorities. By taking the time to truly understand what matters most to you, we ensure your investment plan is designed to help you grow and protect your wealth over time. With years of proven expertise and a client-first approach, our professionals deliver the trusted guidance you need to achieve your financial ambitions.

Here’s how our investment management services stand out:

Our process begins with a thorough discussion with you to determine the risk tolerance and goals for your investment portfolio. Every account we manage is assigned an Investment Objective that aligns with your personal financial goals while maintaining a level of risk/volatility that is comfortable for you. Once the appropriate Objective is selected, it serves as a guideline for investing the account within a specific asset allocation range supporting that specific Objective. We believe asset allocation is the most important decision in the portfolio construction process. Asset allocation is by far the largest determinant of portfolio returns, much more than security selection. As a result, we want to make sure we get this critical decision correct and continue to re-visit the allocation discussion at various life stages to adjust the Objective as necessary with your changing goals and needs.

Once accounts are established and opened, we stay in touch with you through periodic economic and market updates via mail, social media, phone and e-mail. We meet regularly in person to discuss investment returns, review current economic news and market trends, and measure progress toward your goals. If a full-scale financial plan is practical, we have the ability to develop one for you. This extensive plan will take into consideration asset size, expected returns, budgets, social security income, expected tax brackets, and life expectancy to arrive at a detailed projection of how long your money will last post-retirement or how much may be left as a legacy. The inputs can be easily changed to forecast various retirement income, tax, and withdrawal scenarios.

As part of our regular ongoing meetings with you, we will advise on Estate Planning issues (Wills, Trusts, Powers of Attorney), retirement withdrawals (required minimum distributions), and Social Security strategies. We can assist with determining the correct sequence of retirement account withdrawals by account type as well as Social Security claiming strategies. Our goal at Appleseed Wealth Management is to be a trusted advisor that will help you navigate the financial landscape through various stages of life. Partner with us and join us on our mission to provide trusted, personalized wealth management that will help you achieve lasting financial success.

Reach Out Today!

Ready to take control of your financial future? Schedule a meeting with our team today! Let our experts craft a personalized plan to help you grow, protect, and achieve your financial goals.

Investment products are not deposits or obligations of, or guaranteed by Community State Bank or any other bank, are not insured or guaranteed by the FDIC or any governmental agency and are subject to investment risks, including possible loss of principal invested. Past performance is not a guarantee of future results.

| Not Insured by FDIC | Not Bank Guaranteed | May Lose Value | Not a Bank Deposit |

Not Insured by Any Federal Government Agency